is there a state estate tax in florida

If a nonresident decedent owned Florida property a pro rata portion of the credit for state death taxes see Part II Florida Form F-706 is due to Florida. As mentioned above the state of florida doesnt have a death tax but qualifying florida estates are still responsible for the federal estate tax there is no federal inheritance tax.

Florida Inheritance Tax Beginner S Guide Alper Law

Estate tax is a tax levied on the estate of a person who owned property upon his or her death.

. Florida residents and their. You would pay 95000 10 in inheritance taxes. Florida does not have an estate tax.

Florida also does not assess an estate tax or an inheritance tax. A federal change eliminated Floridas estate tax after December 31 2004. In 2022 the estate tax threshold for federal estate tax.

However federal estate taxes may still be due depending on the value of the gross estate. The state constitution prohibits such a tax though Floridians still have to pay federal income taxes. Essentially what happened was if an.

Three Types of Taxes Relating to Florida Real Estate. There are a few states that levy taxes on the estate of the deceased generally referred to as the inheritance tax or the death tax. Estate taxes are levied by the government on the estate of a recently.

CAN A FLORIDA ESTATE HAVE OTHER STATE TAX. The maximum federal estate tax. Previously federal law allowed a credit for state death taxes on the federal estate tax return.

What Is the Estate Tax. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. 097 of home value.

If someone dies in Florida Florida will not levy a tax on. Therefore if no federal estate tax is due then no Florida estate tax would be due. Natio nwide about 476 percent of state-level taxes are collected via sales tax so the 829 percent of total revenues generated by sales taxes in Florida is way above the.

The Tax Cuts and Jobs Act signed into law in 2017 doubled the exemption for the federal estate tax and indexed that exemption to inflation. The gross estate includes trust assets assets held in the. This was not always the case the current set-up is an outgrowth of the old system.

The state abolished its estate tax in 2004. Currently Florida doesnt collect its own Estate Taxes. First Florida has no separate estate tax.

Florida does not have an estate tax or income tax so the only taxes that can apply to a Florida estate are federal taxes. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. You would receive 950000.

Below youll find detailed information about how the state handles its residents. The good news is Florida does not have a. The pro rata portion of the estate tax.

For estates of decedents who died on or after January 1 2005 and before January 1 2013 no Florida estate tax is due. Tax amount varies by county. In Florida there are no state taxes related to inheritance and the estates of those who have died.

Estate taxes are paid by the decedents estate before assets are distributed to heirs and are thus imposed on the overall value of the estate. Florida Estate Taxes. Inheritance taxes are remitted by.

Moreover Florida does not have a state estate tax. An estate tax is a tax on a deceased persons assets after death. Florida does not currently have an estate tax so for those estates located in Florida there would be no tax consequences in Florida.

However in Florida the inheritance tax rate is zero as Florida does not actually have an inheritance tax also called an estate tax or death tax. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance. The exemption amount will rise to 51 million in 2020 71 million in.

Florida is one of those states that has neither an inheritance tax nor a state. Florida doesnt collect inheritance tax. The estate would pay 50000 5 in estate taxes.

198 provides in part that a resident decedent is subject to Florida estate tax equal to. There is no estate tax in Florida. First all properties in Florida are assessed a taxable value and owners pay an annual Florida property tax based on this value except.

Florida did have what is commonly known as a sponge tax which is tied to the Federal Estate Tax. The Florida estate tax is tied directly to the state death.

What Is Inheritance Tax And Who Pays It Credit Karma Tax

Remember That You Don T Actually Own Your Property Try Not Paying Your Real Estate Taxes And See Who Comes To Auction Off Their Pr Property Tax Estate Tax Tax

Pennsylvania Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

5 Ways The Rich Can Avoid The Estate Tax Smartasset

What Is A Substitute For Return Estate Tax Inheritance Tax Tax Preparation

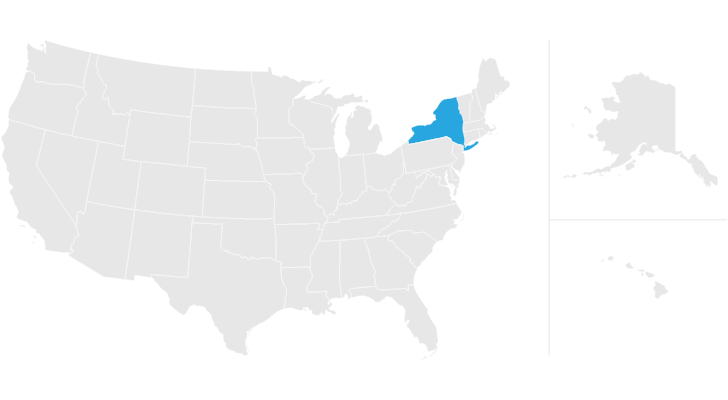

New York Estate Tax Everything You Need To Know Smartasset

New York Estate Tax Everything You Need To Know Smartasset

Tallahassee Property Taxes Property Tax Real Estate Advice Estate Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Is There A Federal Inheritance Tax Legalzoom Com

South Carolina Estate Tax Everything You Need To Know Smartasset

How To Avoid Estate Tax In Bitlife Pro Game Guides

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Florida Inheritance Tax Beginner S Guide Alper Law

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)